Diamond Bank, which was acquired by Access Bank, has about 240 operational branches spread across Nigeria. Most people now refer to the bank as Diamond Access Bank, and despite their unofficial complex new name, the bank still stands out as a premium financial institution with millions of customers using their services daily. Chief among this is to transfer and borrow money. However, due to Diamond Bank’s merger with Access Bank, there has been much confusion on how to go about using the bank’s online channel and also the USSD code. Below is a detailed explanation of using the Diamond (Access) Bank online banking channel and USSD code to transfer or borrow money.

Diamond (Access) Bank Online Banking

Diamond (Access) Bank’s online banking service is an internet banking platform that customers can use to assess a variety of the bank’s services anytime (24/7), anywhere, and at their own convenience. Using the Diamond (Access) online banking service, it’s way easier to make your transfers.

Features

With its featured solutions, which make online banking easy for customers, Diamond (Access) Bank online service enables people to:

- Transfer funds from their account to other accounts;

- Make foreign transactions via their domiciliary account with Diamond bank in USD, GBP, and EURO;

- Monitor activities on their account(s);

- Pay their bills;

- Manage their regular payments;

- Book and manage their Term/Fixed deposits;

- Receive Western Union transfer directly into their Diamond account;

- Book and pay for local and international flights;

- Request for a debit card on their account and set the transaction limit.

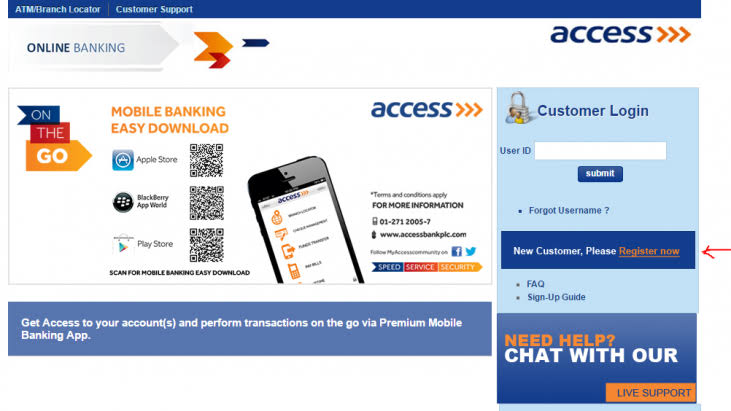

How to Register/Apply for Diamond (Access) Bank Online Banking Service

To start using Diamond Access Online, you’ll need the User ID/Name sent to your email after opening an account with the bank. Otherwise, you can visit any branch close to you to request an Online Banking User ID/Name from their customer service. Once you’ve done that, follow these simple steps:

1. Go to Diamond (Access) Online portal here (https://ibank.accessbankplc.com/RetailBank/#/), and input your User ID/Name, then click continue.

2. If you have forgotten your User ID/Name, click on forgot password and select either to retrieve your username or change your password.

3. Your requested Password will be sent to the phone number you registered on your diamond bank account.

4. Return to the Login Page and Sign in using your internet banking ID and the password you just received.

5. You will be required to change your password and create a PIN that will be used to authenticate and complete your transactions.

6. When all the above is done, you’re good to go.

How to Transfer Money from a Diamond (Access) Bank Account to Another Diamond (Access) Bank Account Online

You’re expected to have an internet connection on an internet-enabled device and login detail (a password) to access the service online. As soon as you log in with your username and password, click ‘to pay,’ the bank immediately sends you a Diamond transfer code. This is a special security code that protects you from fraud. Using the code, you can carry out any payment. Simply fill in the beneficiary’s details, and you are good to go.

What is the Code for Transferring Money From my Diamond (Access) to Another Diamond (Access) Account

The general USSD Code for Access Bank is *901#, and it’s the same for Diamond bank accounts since both banks are now merged into one. So you can use the same code to transfer money from your Diamond bank account to another. The truth is that there are several things this code can do for you. One major thing you need to keep in mind is that the code can only be used with the number registered in your account.

- To open a Diamond (Access) bank account, then you can use the code.

- To recharge your line and that of a loved one.

- To pay bills and make online purchases.

- To check your Diamond (Access) account balance.

- To transfer money to the same bank and a different bank account.

- To generate OTP code.

How to Borrow Money from a Diamond (Access) Account Online

Borrowing money to some may look like a nightmare. There is no way you’ll not be forced to get a loan due to one situation or circumstances or the other. You may need to attend to some urgent needs. To some people, accessing loans can be tough and seems like a no-go area. This might be the case with you. But with the Diamond (Access) bank of today, it’s a walkover. You’re close to your dreamland.

You can borrow money using your Diamond (Access) bank account or as a customer of Remita. The conditions are simple and easy to meet, but you must have a job with a regular salary payment. All these are done online, and you don’t have to visit the bank. With the Diamond (Access) bank code, it’s made easy and reliable for you.

To get a loan facility, all you have to do is log in to your internet banking platform and click on the loan option. You can either go for PayDay Loan or Personal Loan, depending on how urgently you need the loan. However, there are certain requirements you must meet before you can be given a personal loan, while for PayDay Loan, the requirements are not that much.

Diamond (Access) Bank USSD Banking

Another innovative way of transferring money from your Diamond bank account to another is via a cell phone. Dialing figures and symbols in combination to send money can save you the stress of visiting a bank. For instance, if you want to transfer N3000 (Diamond to Diamond), here is how to go about it;

- Dial *901*1*amount*account number#. That is, *901*1*3000*0123576889#

- You’ll be instructed to confirm the recipient’s account name.

- Next is to enter your 4 digits transaction PIN and click ‘sen.’

Features of Diamond (Access) Bank USSD Banking

The Diamond feature is a quick and easy way to carry out any online transactions in your Diamond (Access) bank account. Below are the codes to use.

- Airtime for self *901*Amount#

- Airtime for others *901*Amount*Phone number#

- Fund transfer to Access bank *901*1*Amount*Account number#

- Fund transfer to Other banks *901*2*amount*Account number#

- Account Opening *901*0#

- Data Purchase *901*8#

- Bill Payment *901*3#

- Balance Enquiry *901*5#

- Merchant Payment *901*3*Amount*Merchant code

- OTP Generation *901*4*1#

How to Activate Your Diamond Bank USSD Code

Although the number you used when creating an account with the bank was suppose to have been automatically activated for Mobile Money Transfer, to transfer money with your mobile phone using the bank USSD code, you are expected to have your phone number registered for transactions. Also, you’ll need to create a 4 digits PIN. You don’t need the whole day to create the PIN; in less than 5 minutes, you’re done. Follow these steps to get it done-

- Dial *426# on your mobile device using the number you registered your account with.

- You’ll be required to enter your date of birth, click send after doing so

- Then, enter the last six digits on your ATM card.

- Enter your Diamond bank account number to proceed.

- Finally, you’ll be asked to enter a 4 digits pin. Do so, and make sure it’s a pin you can easily remember.

How to Transfer Money from a Diamond (Access) Bank Account to Another Diamond (Access) Bank Account Using USSD Code

Having known that you can transfer money from your Diamond (Access) account to another Diamond (Access) account using the USSD code. Following these procedures, you should get through easily with it;

- Dial *901*1*Amount*Account number#. This you’re to do using the phone number registered with the account. For instance, to transfer N2000. Dial *901*1*2000*0136678949#.

- Next is to confirm the recipient’s account name. The instruction will pop up after your first dial.

- Enter your 4 digit transaction PIN. You must have gotten your PIN before now.

- Send inquiries by clicking on the ‘send’ button.

- You can also use the USSD code to recharge your line by dialing *901*amount#. For example, *901*500#. Or you want to recharge for a loved one, just dial *901*amount*phone number#. For instance, *901*300*09075892314#. It’s as simple and fast as this.

How to Transfer Money from a Diamond (Access) Account to Another Bank Account Using USSD Code

Transferring money from your Diamond (Access) account bank to another bank in Nigeria is also as simple as ABC. It is stress-free, and you don’t have to go hustling in the banking hall. Just follow these few steps, and you’re done.

- Dial *901*2*amount*account number#. Let me simplify this for you. Let’s say you needed to make a transfer of N5,000. Dial *901*2*5000*0184698302#.

- Confirm the receiver’s bank name.

- Confirm the receiver’s bank account number.

- Enter your 4 digit PIN, which you must have generated before now.

- There’s a pop-up requesting you to ‘send,’ click on it, and your request will be posted.

- Note that for this service, you’ll be charged N84 for commission and VAT.

- A confirmation will be sent to you of a successful transaction.

How to Borrow Money from a Diamond (Access) Account via USSD

Life can come up with emergencies and unforeseen events, leaving you stranded and helpless. That is why Diamond (Access) bank offers its customers an easy and quick way to access loans via the USSD Code. By dialing *901*11*1#, you are sure to receive an instant loan from PayDay Loan through your Diamond (Access) bank account. The Diamond (Access) bank loan finances the need that triggered the loan in the first place.

There are different types of loans Diamond (Access) bank can offer you. One of them is known as Lending Against Turnover (LATO). You can conveniently apply for this loan through PayDay Loan, using the bank loan code. It’s readily available to customers who have had a relationship with the bank for over six months and above, and it is instant and super easy. You can also access Salary Advance Loan using the USSD code.

Being a salary or non-salary earner doesn’t stop you from borrowing money through PayDay Loan. At a low rate with no documentation or collateral, you can borrow money at a low cost. Here are the requirements

- Just dial *901*11*1# and follow the prompts.

It’s a 24/7 service at your convenience, and you don’t have to visit the banking hall. There’s no collateral needed, no documentation of any kind, and you’re given a thirty-one (31) days tenor.

How to Check Your Diamond (Access) Bank Account Balance

Sometimes you might be stranded, not knowing the amount left in your Diamond bank account. Worry not because Diamond bank has an easy and more convenient way to get this done for you.

- Dial *901*00# using your registered phone number.

- Authenticate your 4 digit pin. Just make sure it’s something you can remember, so your line doesn’t get blocked trying a different number.

- After carrying out the above steps, your account balance will be displayed on the screen of your mobile.

You can also dial *901*5# and enter the last 4 digits on your debit card to view your account balance.

Alternatively, you can achieve this is by dialing *426*00# if you are previously a Diamond Bank customer. Your balance will be displayed immediately. Also, if you have the Diamond bank mobile app downloaded, you can log in with your password, and you’ll see the instruction asking you to check your balance. Click on it, and your account balance will be displayed.

To many people, especially previous Diamond Bank customers, it is still a bit complicated to understand and use some of the services Access Bank put in place for remote banking. This is so because the two banks previously had different services they offer and how to go about doing each. But while this might seem a tad complicating, Access Bank, which has now absorbed Diamond bank, tries to continue to make things easier for customers.

For example, when transferring money to an account holder who was originally a Diamond bank customer, you will see the customer’s bank written as Access (Diamond) Bank. Also, Access bank retained Diamond bank’s *426*00#, which former Diamond Bank customers can still use to run checks on their accounts. Perhaps with time, they might phase this out and wholly adopt the more uniform *901#.

The Customer Care Contacts

You can get in touch with Diamond Bank’s customer care representatives through any of these means;

- Head Office: 14/15, Prince Alaba Abiodun, Oniru Road, Victoria Island, Lagos, Nigeria.

- Branches Nationwide: You can find the nearest Diamond Access Bank closest to you here.

- Phone Numbers: To get in touch with the bank’s customer care, call any of these numbers – +234 1- 2712005-7, +234 1-2802500, 07003000000, 01-2273000,

- Email: [email protected].

- Live chat on the website: Click here.

- Social media: Instagram, Facebook, and Twitter.