Union Bank Nigeria is a commercial bank with branch offices located in all states nationwide with an active internet banking service. The bank has an asset base estimated at NGN1.381 trillion ($4.1 billion). Like many other banks worldwide, Union Bank Nigeria serves both individuals, small and medium-sized companies, large corporations, and organizations.

As the 556th largest bank globally and the 14th largest bank in Africa, Union Bank Nigeria has joined the reigning internet banking to enable its customers to transfer funds online, anywhere, any time at their convenience. But to do that, you have to be on the know, which is what we are here for. Before we crackdown on the details, let’s find out what services Union Bank’s Online Banking system can accommodate.

Union Bank Nigeria Internet Banking Services

The Union Bank internet services make for an easy banking process. Union Bank customers enjoy easy banking at the comfort of their homes. The internet banking service can be carried out anywhere and at any time. All you need to do is to have a good internet connection and a smartphone. With Union Bank internet banking, you can send and receive money at the comfort of your home, buy airtime for yourself and others, monitor activities in your bank account, among others.

Internet banking services are the new trend in the banking industry since we are in the internet age. When internet banking started newly in Nigeria, customers visit their banks for activation of mobile apps and internet banking set up. However, with time, signing up and activation of internet banking services has become easier. You can either apply for the internet banking service at any Union Bank branch or do it yourself by following some simple steps online.

Now that we are clear of what internet banking is all about Let’s explore the different channels you can access the internet banking services. And also how to register for each one.

List of Required items Needed to Sign-up for Internet Banking

To sign up for any of the Union Bank internet banking services, you need to have the following items.

- A smartphone

- Mobile data for internet connection

- The phone number used to open the Union Bank account

- A combination of numbers you will use for your PIN. These numbers should be unique and easy for you to remember.

The Union Bank Nigeria Internet Banking Channels, and How to Sign-up for them

Union Bank has three internet banking channels. All these channels have their specific purposes. Let’s look at these channels and explore what they are used for and how to activate them.

UnionMobile

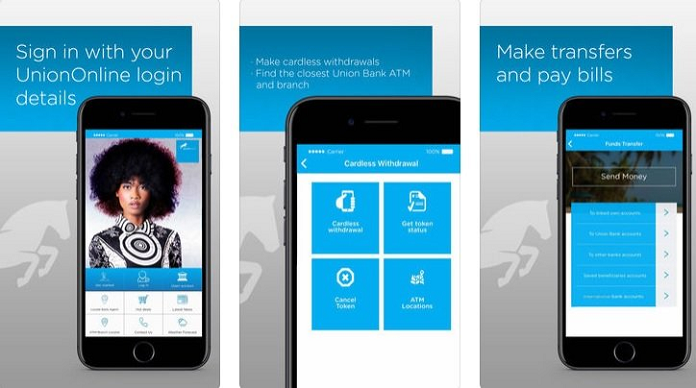

The Union Bank Mobile banking is like keeping tabs on your account while on the go. UnionMobile is an app for internet banking used to keep tabs on your savings and current accounts. You cannot manage corporate accounts with the app. All you need is your smartphone or mobile device to enjoy fast, safe and convenient transactions anywhere.

With an internet-enabled smartphone or mobile, you can use UnionMobile to:

- Open an account

- Send and receive money

- Pay bills

- Check account balance

- Buy airtime

- cardless withdrawal

- Get insurance

- Book flights and hotels

- Pay school and exam fees

- Email banking

- Locate a branch, ATM stand, or an agent

However, to carry out any of the aforementioned transactions, your mobile phone number must be the same as the one you used to open an account with Union Bank.

How to Activate the UnionMobile App

The following is a step-by-step procedure on how to register and activate the UnionMobile App on your Smartphone.

- Download the UnionMobile app to your phone from the app store

- Accept the Terms and Conditions

- Enter your account number. An OTP will be sent to the phone number you used to register your bank account.

- Enter the OTP

- Create a Username and Password

- Choose a new transaction PIN and password

- Submit and return to the home page

The transaction PIN is what you will use for transactions any time you want to use the app.

The UnionOnline

The UnionOnline service is carried out on the Union Bank’s website. Union bank internet banking is for savings, current, and business accounts. However, savings account and current account owners make use of UnionOline for their internet banking. Whereas the business account owners make use of Union360. With UnionOnline, you can get the following 24/7 services from Union Bank:

- Transfer money

- Pay bills

- Check account balance

- Get statements

- Review transaction history

- Set up standing orders or instructions

How to Sign up for UnionOnline Banking Service

You can register for this online banking yourself or visit any Union Bank branch to register. If you are doing it yourself, here’s a few steps to follow:

- Visit Union Bank website www.unionbankng.com

- Click on “Internet Banking”

- Click on “Not Enrolled? Sign up now!”

- Enter your account number and continue

- Input the OTP (One Time Password) sent to your registered mobile number

- Create your username and password

- Confirm your details and submit

- You can now access your online service with the username and password

The Union360

Business account owners, also called corporate clients, make use of Union360 for their internet banking. Union360 is Union Bank’s platform for Corporate Internet Banking, and it is web-based. This is organized to meet your business needs. With this internet banking service, you can pay and receive payments without stress. With the Union360;

- You can make a payroll

- Manage bulk or single payments

- Manage vendor or supplier payments

- And you can easily generate all the reports you need

- You can initiate border payments in major currencies

- You can create future date payments and sweep instructions

- Single, bulk, and multiple payments can be carried out to interface with the ERP and accounting software of an organization.

- Cheque books can be requested, and cheques can be confirmed with it.

How to Register for Union360

You can register for Union 360 by doing the following:

- Visit https://www.unionbankng.com/business/union360/#how-do-i-register-for-union360-

- Click on “Click here to get started.”

- Download the form and fill it

- Then send the completed forms to [email protected].

- You will be communicated on the next steps to follow.

However, you can also visit a Union Bank branch if you are not comfortable doing it yourself. If you want to visit the bank, here is the procedure to follow.

- Visit the bank and request your online banking details

- Fill the form that will be given to you and submit

- A default password will be sent to your mobile number once the application has been processed.

- Then go to the Union Bank website- www.unionbankng.com

- Click on the Internet Banking button

- Log in with the username you filled in the form and the password sent to you.

- You can change the password if you wish

How to Buy Airtime from Union Bank Internet Banking Platforms

UnionMobile

- Log into the app

- Click on the Airtime top-up button on the app’s home page

- Enter the number, choose the network, choose the account to use, and the amount you want to recharge

- Enter your PIN to complete the transaction.

USSD Code

You can buy airtime for yourself and a third party through the Union Bank mobile banking code.

- For self, dial *826*amount#

- For a third party, dial *826*amount*third party phone number#

- Or you can dial *826# and follow the prompt to recharge for yourself or a third party.

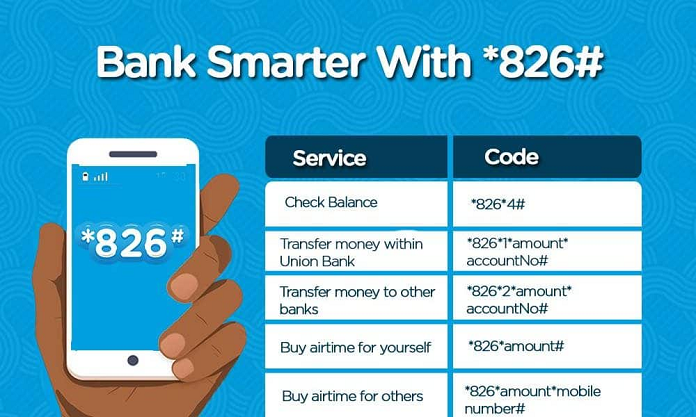

Union Bank USSD Mobile Banking Codes

As against internet banking, USSD codes are used for mobile banking purposes. It can be done with any mobile phone with or without an internet connection. It does not require the use of an internet connection to perform its transactions. All you need for this is the mobile number you used to register with the bank. You can perform all the transactions listed above for internet banking with USSD mobile banking code.

To transfer money from your Union Bank account to other Banks in Nigeria, dial *826# on your mobile phone and follow the on-screen instructions. If you have not used the code before, you will have to activate it and get a PIN. For activation, follow the following steps.

- Dial *826# your registered mobile number

- Accept the charge for USSD transaction

- Select the first option; Activate Mobile Banking

- Enter your account number

- Enter the last digits of your ATM card

- Create a 4-digit secret PIN you can remember

- Then a confirmation message will be sent to you.

- You have successfully signed up for your USSD mobile banking, and you can use the service any time.