FIRS TIN registration and verification are two different processes in acquiring TIN in Nigeria. These processes are not difficult and do not take much time. For one to get the FIRS TIN for an individual or a business, they have to visit any FIRS tax office for this.

The verification can be done online as well at the tax office. This article will give you the step-by-step procedure on how to register for your FIRS TIN and how to go about the verification process.

What is FIRS TIN Number?

The FIRS TIN is a unique code or number that is used to recognize a taxpayer in Nigeria. The FIRS (Federal Inland Revenue Service) is a federal agency or body responsible for the assessment, collection, and accounting for tax and other revenues in Nigeria.

To do this, the agency issues a number called TIN (Taxpayer Identification Number) which is an identifying number, to individuals and companies for the payment of their taxes. The FIRS TIN is used by individuals and companies to pay their taxes and other revenues to the Federal Government of Nigeria.

Since tax payment is compulsory, everyone and businesses need to have their unique TIN for the following purposes.

- TIN is needed for getting government loans

- It is required for the registration of cars

- You need it for opening a corporate bank account.

- If you want to apply for trade, import, and export licenses, you need your TIN

- FIRS TIN is needed for the application for a certificate of occupancy.

- It is also needed for foreign exchange.

- TIN is needed to get a tax clearance certificate for yourself or your business to show that you have been paying your taxes.

FIRS TIN Registration

Registering for your TIN is not a difficult task but has some processes. Once you have provided the right documents and followed the processes, you will get your unique Taxpayer Identification Number (TIN).

FIRS TIN Registration for Individual

Individuals who have their NIN and BVN already have TIN created for them. All they have to do is to visit the TIN verification website to verify their TIN. However, if the TIN verification portal could not find your TIN, then visit any tax office for fresh registration.

FIRS TIN Registration for a Company or Business

For your business or company, you must have incorporated or registered your business with the Corporate Affairs Commission (CAC). Then visit any Federal Inland Revenue Service (FIRS) office close to you for your TIN.

From 2020 new businesses get their TIIN when they register their businesses with the Corporate Affairs Commission. They don’t have to apply separately for their TIN. All they need to do is to go for TIN verification to validate it. However, if a registered business does not have its TIN yet, the process below should be followed to get theirs.

To register for FIRS TIN, you need to follow these procedures.

- Visit any Federal Inland Revenue Service (FIRS) tax office close to you

- Go with the original and photocopies of your documents

- Tell them your reason for visiting, and they will guide you through the processes

- Collect and fill out the application form

- Submit the completed form with other required documents and ID

- After the registration, the TIN will be generated immediately or in due time and given to you

Alternatively, you can register online for your business or company. You can register through the Joint Tax Board website since it is acceptable to FIRS. To register online, you have to follow these steps.

- Visit https://tin.jtb.gov.ng/TinRequestExternal

- Fill the required fields in the form

- Click the I am not a robot box and submit

- Your TIN will be generated for you

List of Documents Needed for TIN Registration

For these documents, you are to go with the original copies for sighting and photocopies that will be submitted. For individuals, below is a list of documents needed for a successful TIN registration.

- Your form of identification National Identity Number (NIN)

- Your Bank Verification Number (BVN)

- Registered phone number

- Utility bill

- Email address

- Passport photograph

- Duly completed FIRS TIN registration form, which will be issued at the tax office

The following documents are required for your TIN registration for a company or registered business.

- Documents from Corporate Affairs Commission to show your business is registered

- Application letter with the company’s letterhead

- Particulars of your company’s auditors, directors, and major shareholders

- CAC Registration number

- Email address

- Date of incorporation of your business

- Duly completed FIRS TIN registration form

- Form of identification

FIRS TIN Verification Form

Getting the FIRS TIN verification form is not a big deal. If you want to do the verification at a tax office, you must visit the office and request the verification form. Fill out the form accordingly and submit it for verification.

On the other hand, if you are to do the verification online, you don’t need a physical form—just key in the required information on the verification portal and search. Your unique FIRS TIN will be displayed to you on the screen. The process is so easy that you can do it in the comfort of your home without anyone’s help and without visiting the tax office.

FIRS TIN Verification System

TIN verification is the process of validating one’s TIN. This is done online or through an app provided by the Bureau of Internal Revenue (BIR). The BIR Mobile TIN Verifier App is an app used by taxpayers for TIN validation and other TIN inquiries.

Through the FIRS TIN Verification Website

This is for both individual and business verification.

- Visit https://apps.firs.gov.ng/tinverification/

- Select a search criterion (BVN, NIN, or registered phone number

- Fill in the number

- Click search

Through the Joint Tax Board (For Individuals)

- Visit the registration portal https://tinverification.jtb.gov.ng/Template/TINVerification

- Enter your date of birth in the space provided for it

- Choose a search criterion from the options provided (BVN, NIN, or a registered phone number)

- Fill up the required number contained in the search criteria you provided (If you chose BVN, then enter your BVN)

- Verify you are not a robot by clicking the reCAPTCHA box

- Click search to view your TIN

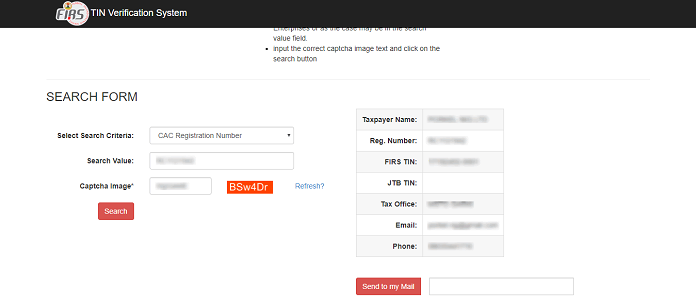

For Business or Company

- Visit the Verification portal https://tinverification.jtb.gov.ng/Template/TINVerification

- Input the company or business’ date of incorporation in the space provided

- Choose a search criterion – CAC (Corporate Affairs Commission) registration number or TIN

- Enter your CAC registration number

- Verify you are not a robot by clicking the reCAPTCHA box

- Click search to view your TIN

List of Documents Needed for TIN Verification

For the verification process, if you are to do it online, the information listed below is needed. If you wish to visit a tax office, you will need this information and a completed verification form.

For Individual

- Date of birth

- BVN or NIN, or registered phone number

For a Company or Business

- Date of incorporation of the business

- CAC registration number