Ecobank is a modern bank with its presence in 36 countries in Africa, being on the front line doing business in the banking sector around West Africa and Central Africa. Through Ecobank mobile banking, the bank has shown a whole lot of service delivery efficiency in all the regions it operates over the years, as it allows its customers to conduct their financial services conveniently.

Ecobank’s strides cannot be fully emphasized without mentioning the Ecobank mobile banking platform. Obtained on this platform are financial services that work 24 hours a day, seven days a week; in all the countries it operates at any point in time. These services could be carried out on mobile phones and mobile applications.

What Is Ecobank Mobile Banking?

Ecobank mobile banking is a type of banking that allows its customers to do their financial transactions with their mobile phones. The platform gives the same banking service that their customers can get in the banking hall, like deposits, transfers, and bills payments through touching a phone. It is a banking system in which Ecobank has helped its customers bring down the cost of service and speed of transaction for efficient use of funds.

Contrary to conventional banking methods, Ecobank mobile banking embraces all platforms attainable under the cashless policy, which has taken over today’s businesses. It also creates numerous avenues where customers can interact with the bank without coming to the branch. Through these interactions, they also get their queries resolved and banking issues solved.

Different Channels Found In Ecobank Mobile Banking Platform

Below are some systems of Ecobank mobile banking platforms.

1. Ecobank Mobile Banking App

It is a system of mobile banking experience provided by Ecobank to its customers through an application that could allow them to have access to taking advantage of its banking services quickly when they are buying kinds of stuff, deposits, or paying for services through the internet, which can be downloaded into their android phones. The mobile App could be gotten from Google Play and Apple stores with these features.

What You Can Do With The Mobile App

- With the Ecobank mobile app, you can open an account that you will use to carry out transactions of sending, paying, and shopping. You can open an XPRESS account as soon as possible without going to the banking hall using ECOBANK MOBILE BANKING.

- Send money to anybody in and around 36 African countries it has its base. The app enables customers to quickly transfer money between accounts at their own pace conveniently than going to the bank in person.

- Shop and pay for goods purchased online

- Pay utility Bills, Airtime recharge, Airline ticket purchase

- Check balance

- Track transactions to avoid situations of double-paying when effecting transfers. This is because the customer’s account displays activities of all transactions that had occurred in a stipulated period upon requests.

- Make huge payments

- Link your VISA or MASTER CARD to your accounts

How To Download And Activate The Mobile App

To download the Ecobank app, you will need an internet-enabled phone. If you have that ready, then follow these simple steps:

- Go to the App store on your phone

- Enter ‘Ecobank Mobile App’ in the search space and press enter

- Click on ‘Install’ when the app appears

If you have a good data connection, the app will immediately be installed on your phone

Activating The Mobile App

Once the app is successfully installed, it will appear on your phone screen. Once this is done, you are to do the following to activate and register the App.

- Click on the installed Ecobank Mobile app icon on your phone to launch it

- Using your registered phone number, dial *326#

- You’ll be required to change your pin

- With your newly activated pin, you can then log into the app and start using it.

Note: If you’re a new user, all you need to do is click on ‘New User’ to register your account and follow the instructions to the end.

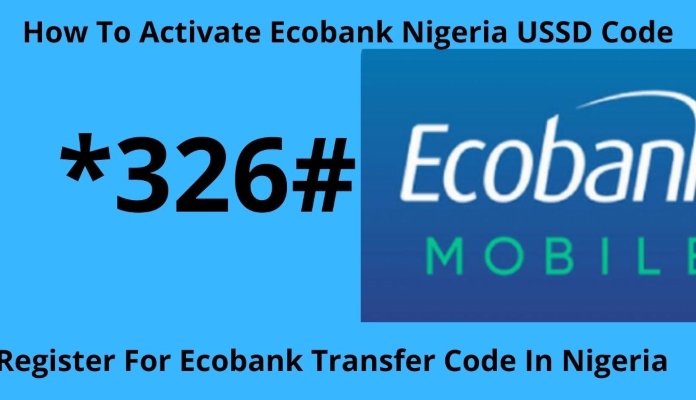

2. Ecobank USSD Code

USSD is Unstructured Supplementary Service Data that gives customers access to do mobile banking through codes. The USSD saves customers the stress of standing in long queues to do transactions as attained in traditional banking. With the advent of mobile phones, you find out that you don’t need to go to the bank anymore for payments of bills, airtime credit recharge, e.t.c.

You can do that with the same phone you use in making calls. As long as you dial numbers on your phone, you can equally dial shortcodes to pay a bill or do phone credit recharge after exhaustion. Ecobank mobile banking has made banking easier and a lot more fun to do for customers on the go. With this system, you don’t need to purchase internet data bundles, unlike mobile App banking in which you cannot gain access to on your device without internet service.

The USSD short code *326#, when typed through a phone number registered to Ecobank account, gives access to some transactions like making transfers to friends, family members & business associates, checking balances on account, pay for DSTV or PHCN Bills, reading statements, and Buying airtime and Data for self or Third-party anywhere, whenever the need arises.

How To Register And Activate The Ecobank USSD Code

Any ECOBANK customer would register and activate the bank’s USSD shortcode to access their services by following the steps below.

- Using the registered on your Ecobank account, dial *326#

- You’ll be asked to choose the debit card that is linked to your account. Enter the appropriate details.

- Click on submit to complete your registration

How To Activate Your Pin for USSD Transactions

You’ll be asked to enter a 4-digit pin, which you will use to authorize all transactions.

- Enter your 4-digits pin and make sure you choose what you can never forget

- Click submit

- Shortly after that, a message will be sent to your phone

- Type *326# and follow the registration command, which must be done with a phone number linked to any ECOBANK account.

What You Can Do With The Ecobank USSD Code

- Buy or Recharge Airtime

Whenever an ECOBANK account customer, friend, or family member runs out of phone credits, they could easily purchase the airtime by just doing the following from their phone instead of being stranded.

-

- Dial *326# and follow airtime selection instructions for airtime purchase or simply,

- Dial *326*Phone number* amount# to buy for Third-party phone numbers or numbers that are not linked to your ECOBANK account.

- Transfer Money

To transfer money, follow these simple steps:

-

- Dial *326# with your Ecobank account linked Phone number

- Go to Funds Transfer

- Type recipient account number

- Choose the bank

- Confirm details

- Type your four-digit pin to effect the transfer

- Check Account Balance

A customer of ECOBANK can constantly monitor their spending by checking their account balance with the USSD service. To know your account balance follow the steps below:

-

- Dial *326#

- Select account balance

- Enter your pin

- You will see your balance on your screen.

NB: Always keep your pin safe and secure so that no other person can authorize your transactions without your knowledge or consent.