The advent of the internet brought enormous economic growth, especially to individuals who embraced the development and brought business ideas into it. Most online business-minded individuals find the internet as the best and suitable environment to reach out to their target customers, especially now that everyone is in one way or the other a member of one social media community. These online platforms helped in the easy process of closing business with customers in a very short period. Also, to customers, online businesses in Nigeria brought about the availability of products and services closer than ever.

Several Online Businesses Have Been Widely Adopted In Nigeria

Working on the internet has been in existence, and many people have taken it as a side hustle and some as full-time work. Some didn’t see the potential, creativity, and satisfaction they would gain by giving their whole time in running their businesses online. Sadly, the outbreak of the COVID-19 pandemic forced many people out of their job and confined them into staying at home. Nevertheless, those with the knowledge of online businesses in Nigeria ventured into developing skills to accomplish sales online.

Even some medical doctors and pharmacists developed online business platforms to offer medical services and deliveries, which they still find more active at the end of the COVID-19 lockdown. Although many people now take the internet as a means of earning their livelihood, others still believe they don’t have to give in all their time to working online. They take online businesses as a side hustle to their main job. They venture into online businesses that are not time-consuming but have a reasonable yield. While such people see online business as a means of supporting minor needs, there are those it is their major means of making money.

Online Businesses In Nigeria That Pay On A Daily Basis

1. Freelance Writer

Freelance writing is one of the independent online businesses in Nigeria that entails writing for clients. One can choose to work independently or for an organization and still have his time for other activities and at the same time earn. Freelance writing pays as the effort one puts into it. So before venturing into freelance writing, make sure there is an existing hunger for writing and not just to earn but for the fun of it. A freelance writer is involved in the following three areas:

- Writing.

- Handle different projects effectively.

- Having an understanding of digital measurement systems.

Freelance writers can venture into the following aspects of writing:

- Blog posts.

- Press release.

- Website content writing.

- Internal corporate communications.

- Emails.

- Grant writing.

- Proposal.

- Newsletters.

Freelance writers are advised to focus on one of any of the above freelance writing areas. This is a field in online businesses in Nigeria that offers the opportunity to work for different clients on multiple projects, thereby creating different income channels.

Important Metrics For A Freelance Writer

Freelance writers work in line with the developed company aim by the company content strategists to create written content that will encourage and promote the organizational goal.

How to Become a Freelance Writer

- Get to know if you have a good writing skill

- Select a freelance writing niche

- Make proper research on your niche

- Develop a target client

- Create a freelance writer website

- Get signed up for professional content sites

- Link up with marketing agencies

- Make use of social media to promote your freelance writing platform

- Have your own freelance writing rate for your clients.

2. Online Tutor

This is one of the online businesses in Nigeria aimed at transferring knowledge through the use of internet platforms to a target audience. Remote tutoring is an embrace of technology in giving out knowledge. This gives total maximum flexibility as it allows complete interaction between the students and the teacher. Some of the technologies employed by remote tutors are:

- Artificial Intelligence

- Virtual Reality

- Cloud Technology

How To Become A Online Tutor

To become a remote tutor in Nigeria is very much easy as long as the tutor has the following requirements:

- An internet-enabled electronic device.

- Teaching skills.

- Communication skills.

- Sound Knowledge of the subject to tutor.

- At secondary school level requires a bachelor’s degree in the subject.

- Tutoring at the university level requires at least a Master’s degree in the course.

- Time management skills.

It is noteworthy that someone interested in running an individual remote tutoring website has an academic qualification though it is not compulsory. Having a good knowledge of what you wish to dish out to the public is great to make things flow.

3. Website Copywriter

Copywriting is a means of developing content in written form for an advert or promotional purposes. Most of the successful products in the market passed through the creative hands of professional copywriters who understand the belief pattern of their target customers. A copywriter must have the ability to create action-driving content to target customers, knowing fully well that the aim is to push sales towards a given product or service.

Categories of Content to be produced by a Web Content Writer includes the following:

- Press release

- Blog posts

- Infographics

- Original research

- FAQ pages

- Case Studies

- Social media posts

- Email newsletters

Examples of contents expected to be produced by a web copywriter:

- Sales copy

- Display ads

- Service pages

- Sponsored posts

- Ecommerce product descriptions

- Search ads

- Landing pages

4. Video Ad Creator

Video advertising is a strategy that each small enterprise proprietor should bear in mind. It is not only the most effective form of effective marketing, but it helps boost sales and promote brand reputation. The method gets to cover a wide range of targetted customers; that is why it’s so effective to create a powerful video advert for your small enterprise.

Factors To Consider Before Creating A Video Ad

- A need to solve a problem

- Have a content format

- Select a platform

How To Create A Good Video Ad

- Focus on making the first scene in the video catchy.

- List out the distinguishing factors of your brand.

- Time your video ad.

- Give a convincing reason why customers should choose your product or service.

- Drag your target customers into action.

5. Online Newsletter Services

This ranks well as part of online businesses in Nigeria that engage one in writing on current happenings about people, events, products, and services updates through different channels online. Some of these online newsletters provide updates on a daily, weekly, monthly, and quarterly basis.

How To Venture Into Online Newsletter Services

- Have your own newsletter goal.

- Source for contents.

- Have a designed template.

- Create your newsletter size.

- Include the body.

- Input personalized smart content.

- Choose a subject line.

- Have newsletter content that is supported by alt text.

- Be sure to be legally compliant.

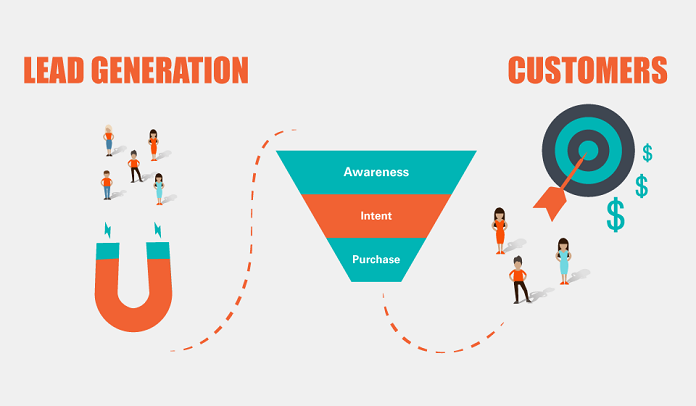

6. Lead Generation Services

Where conventional marketing methods, including email blasts, were sufficient to draw clients, the increase of competition and information abundance makes it more challenging for businesses to tune, attain, and interact with potential customers. Lead era, the advertising technique of stimulating and taking pictures of interest in a service or product to develop an income pipeline, allows companies to nurture targets until they’re geared up to buy.

Lead generation services can benefit any type of business enterprise, both B2C and B2B spaces. Sixty percentage of entrepreneurs accept lead technology as a key factor for organizations. Figuring out an excellent lead is extra complex than simply concentrating on folks that downloaded your white paper, and it’s crucial that your sales reps don’t waste their time calling unqualified leads while there are ways to slide down the pool.

Areas Lead Generators Handle In Marketing

- Database for lead generation.

- Under analytical department.

- Enhance content and lead channels.

How To Be A Lead Generator

- Develop enough irresistible opt-in opportunities.

- Keep on running tests but apply caution.

- Have clarity on your landing page.

- Create good ads.

- Keep on running marketing.

- Get competitors, customers through google ads.

7. Podcasting

Podcasting is a free service that lets internet customers pull audio documents (typically MP3s) from a podcasting internet site to listen to on their computers, smartphones, or private digital audio players. The term comes from an aggregate of the words iPod and broadcasting.

Unlike net radio, users don’t have to ‘tune in’ to a particular broadcast; instead, they download the podcast on-demand or subscribe through an RSS (Really Simple Syndication) feed, which mechanically downloads the podcast to their computers. The technology is similar to that used in private video recorders that let customers set which applications they’d like to report after which automatically records those programs for later viewing.

How To Start Podcasting

- Have a topic and name.

- Have a format for the episode.

- Develop a cover art.

- Get a microphone.

- Invite guests if necessary.

- Record and edit.

- Launch.

8. Affiliate Marketing

Associate advertising is a platform where one can promote another organization’s service or product in return for a fee on the sales you generate. This is one of the online businesses in Nigeria where commissions are commonly a percentage of the sale fee. However, this fee can come occasionally.

What can motivate one into affiliate marketing?

- It involves a very low cost to venture into and has a little risk attached.

- Very easy to accomplish once you gain experience.

How To Start Affiliate Marketing

- Choose a platform.

- Select a niche.

- Locate an affiliate program to join.

- Develop interesting content.

- Direct traffic to the affiliate site.

- Try and have a click on the affiliate links.

- Have your clicks converted to sales.

9. YouTube Personality

If you commit to YouTube enough, you can even make it your sole supply of profits as long as you have got content material that your audience needs. Some people turn out to be YouTube personalities because they have the expertise that they want to monetize through YouTube.

How To Become A YouTube Personality

- Have a YouTube channel.

- Select a niche.

- Subscribe to YouTube channels of your interest.

- Develop good content.

- Make use of a clear video.

- Learn how to edit videos.

- Advertise your channel.

- Reply to your audience when they demand clarifications.

- Be comfortable and keep on working hard.

10. Online Course Creator

An online course creator is a person who develops virtual mastering materials. Your students will complete your classes, carry out exercises, and place their expertise to the check by means of taking quizzes and exams, all from their devices. Turning your knowledge into an online course may be an effective way to earn additional income. Even though it will require an investment of effort and time, it creates a reusable resource. An outstanding virtual class could earn you recurring revenue for months or maybe years.

How To Be An Online Course Creator

- Select a topic.

- Run market research.

- Arrange your content.

- Develop your course.

Online Businesses In Nigeria For Students

11. Web Designer

This is one of the lucrative online businesses in Nigeria that one can engage in as a full-time or part-time activity. A lot of companies are venturing into showcasing their activities on the internet through the creation of websites. Website designers are responsible for developing the website designs and layouts for a company or business enterprise. One can take up the responsibilities of creating a new website or even re-shaping an existing website.

Web designers know about increasing the website’s content to align with the company’s growth. One can argue the difference between a web designer and a web developer. Still, the fact remains that a web designer, in most cases, handles the same duties as the web developer as long as the web designer knows internet coding languages. Therefore it is recommended that all web designers endeavor to learn coding language to function properly in the business.

A web designer can make a living through the following ways:

- By creating a series of website designs.

- Creating means of getting feedbacks about websites under review.

- Designing websites that stand the taste of current technological demands.

- Developing user-friendly websites.

- By having comprehensive knowledge of digital refurbishing and image editing.

12. Online Researcher

Internet researchers or online researchers use their competencies to search the net for information on an extensive style of subjects. This is one of the online businesses in Nigeria where one can work as a freelancer, contract employee, or instantaneous remote employee of a company. You need to be particularly skilled with computers and have a strong knowledge of a way to use a search engine to get admission to scholarly research, enterprise publications, and think tank files to discover statistics for any project on which you’ll be running. Information analysis is every other critical factor of a web researcher’s process, as they should be capable of examining and interpreting the resources they find.

A way to emerge as a successful Online Researcher

You do not need a degree to turn out to be a web researcher. Instead, you simply need to understand how to use online tools to speed up and successfully provide you with reliable and genuine data. However, you might need an understanding of the fundamentals of SEO to recognize how keywords match your search to discover information. It is also helpful to focus on positive regions of research to know the area to look at and whether or not a sure resource to trust.

13. WordPress Theme Developer

One factor driving its full-size popularity is that users don’t have to understand coding skills to build a WordPress website. They can effortlessly enlarge the WordPress website’s capability through plugins, personalize its appearance with a theme, create and publish content, upload multimedia, configure its settings, and above all without a single knowledge of coding. However, the absence of a whole loss of technical know-how can lead to troubles during the process. Some amateur users warfare with securing their website, backing up their records, completely customizing their topic, and redesigning their internet site.

Those are just a few reasons that users are seeking out WordPress theme developers. In Nigeria, many upcoming media houses are battling these problems and are seeking the services of a good WordPress theme developer. WordPress developers in this area create custom themes. They can either create it for personal customers, launch it without spending a dime inside the WordPress theme listing, or launch it on the market on a 3rd-party market or site. There’s additionally a professional guide for WordPress theme developers.

14. Blog Network Creator

A blog network is a set of blogs owned by one or more people commonly related to one niche inside the institution of niches that bloggers post articles for. A blog network is a public network of blogs, and they may be on the equal IP deal with at the equal server. The individual/s who creates a weblog network would not fear approximately using specific IP addresses and a couple of region-primarily based servers while website hosting the weblog.

Blogs on a blog community may be built on WordPress, HTML, Medium, Blogger, or any weblog website hosting platform.

How To Develop A Private Blog

- Get a good domain name.

- Successfully register your domain.

- Footprint-less Hosting.

- Choose the safest PBN Hosting Package.

- Select WordPress CMS for private blog networking.

- Structure a website that doesn’t have a footprint.

- Run a Structure and Index.

- Run regular Updates.

- Track the website on spam score and backlinks.

15. Stock Photographer

Stock photographs are accepted pix, illustrations, and icons created without a selected project in thoughts. They may be then licensed, typically for a price, to people or organizations to be used in advertising substances, websites, packaging, ebook covers, and extra. Masses of inventory platforms are beginning to specialize in precise styles and sorts of stock images, consisting of extra diverse stock snapshots and more realistic, herbal stock imagery.

How To Become A Stock Photographer

- Ask for proper model releases.

- Do a proper keyword on your photos.

- Run necessary editing on your photos.

- Always have photos to supply.

- Avoid photos with brands and logos.

- Have your own domain style.

- Keep to the style that pays.

- Reserve some space texts or headlines near the shot.

- Take more photos.

16. Resume Writing Services

You’ll be considered an expert in your preferred field, but does that qualify you to put in writing a resume? Probably no. The fact is that resume writing calls for a sure talent set that most people don’t possess. And however, without those skills, we may war to correctly bring our actual cost and a potential value in our resume. That’s, in particular, true in today’s extraordinarily competitive work surroundings.

Hiring managers have become adept at filtering out awful resumes, and they even have software to assist them in that effort, which is the Applicant tracking system, or ATS.

In fact, the ATS applications constitute yet another assignment. That instigates one to make sure the resume is to be written in a manner that caters to the ATS requirements. Otherwise, the software program will reject your resume, and you’ll in no way even get a threat to have it checked out through human eyes.

If you can write a resume that covers the ATS requirement, then you are good to offer online resume writing services to millions of Nigerians seeking employment but were knocked off severally by the software.

How To Make A Difference In The Online Resume Writing Business

- Give supplemental services.

- Stand out from your competitors.

- Offer discounts and promotions and even free trials.

How To Start A Resume Writing Online Business

- Select your type of business.

- Resume freelancing.

- Get a business license.

- Get franchise from leading companies.

- Determine a moderate starting service charge.

- Take care of the necessary logistics.

- Develop a portfolio.

- Advertise your resume service.

- Base on professional development.

17. Virtual Tech Support

This online job involves solving questions related to technical problems about a product or service. In Nigeria, there are a lot of businesses in search of a virtual tech support expert. Due to the lack of such experts in the country, they seek the services of these experts outside the country. The main duty of virtual tech support is to provide a high level of customer service in resolving complex technical problems.

To venture into virtual tech support, you must have the following qualities:

- Excellent problem-solving skills.

- Must be self-disciplined.

- Be highly attentive to details.

- Must have excellent communication skills.

- Must have passion for technology.

18. Contract Customer Service

In Nigeria, some online business-minded individuals are venturing into establishing independent customer service, rendering organizations to firms at an affordable rate. These individuals now recruit customer service agents who they assign to companies. It takes only good English fluency and customer service experience to venture into this online business.

To venture into customer service on a contractual basis, one needs to apply to the company and sign the customer service agreement. If both parties accept the terms of engagement, all the customer service duties now go to the independent customer service representative.

19. Proofreader

A proofreader is one who can point out spelling, punctuation, and grammatical errors in any given sentence, article, journal, etc. They conduct all-round scrutiny on any document considering the format the document is written in, avoiding duplication of a sentence and error or omission in the written document. They also consider the headings and the format the heading appears in, and other factors.

Proofreading is the final stage in the editing process, and at this point, the last point of editing as the document is passed on from the copyeditor down to the proofreader. As the final point of editing, a proofreader will have to run through all other editing roles to ensure accuracy in this piece of writing.

In Nigeria, many publishers are in desperate need of professional remote proofreaders, making it a viable remote work to venture into in the country. Educational requirements exist in venturing into this line of online business, but any other discipline with a high understanding of written language can make a stand as a proofreader.

Skills Expected Of A Professional Proofreader

- Good written skills.

- High level of English language understanding

- High level of organization.

- Properly self-discipline.

- Computer literate.

- Very focused on details.

- Very able to use initiative.

- Able to adapt and handle pressure considering deadlines.

20. Domain Reseller

This is one of the typical middleman forms of online businesses in Nigeria but exists in a very lucrative way through the internet. Domain reselling or flipping for profit is part of the online businesses that focus on buying domains and reselling them to make a profit. This has been a good online business globally as the likes of GoDaddy and Namecheap have found a firm ground doing it. In Nigeria, it still stands as an open investment ground for anyone interested in running an online business that pays well.

Truthfully, the business is not a fast earning business that can give you six figures overnight. But a few domain names can offer six figures return, yet it is not one of the online businesses that come with loss. A domain reseller should have in mind that it is not only .com domains that fetch a good profit.

Below are steps to successfully venture into domain reselling:

- Try and have a budget: Seat back and have a financial plan on the amount you will likely invest in sourcing domain names.

- Have a Profitable Niche: A good niche helps one get customers who will be interested in the domain name one has to offer.

- Ability to Find Keywords: This will help one avoid domain names of less interest to customers. Knowledge of keywords helps in gaining domain names with hot traffics of thousands of searches per month. Google Keyword Planner or the Niche Finder Software is a good tool for achieving hot keywords.

- Pay more attention to local domain names.

- Look for an existing domain name.

- Always go for Domain Names that relate to your keywords

- Also, go for domains with a good page rank

- Create a strong domain portfolio

- Don’t be in haste to sell-off

- Acknowledge the associated legal risks on any domain you are buying

Going through the above tips to achieving a successful domain resale online business, one will definitely make ground in Nigeria.

Lucrative Online Businesses In Nigeria For Everyone

21. Travel Consultant

Travel Consultant is an independent travel coordinator saddled with the responsibility of arranging all travel-related needs of their client. Such travel-related needs include hotel accommodation, tours, and sightseeing, etc. They create an online platform where they get all manner of client that has travel needs.

Some of the clients expected by travel consultants include:

- Families going on vacation.

- Students studying abroad.

- Honeymoon tours by newly wedded couples, etc.

To make a good travel consultant, one needs to consider the following:

- The budget of the client.

- Health and risks associated with the travel.

- The hobby of the client.

- The Custom and traditions of such a client.

- Associated weather of the client’s intended location.

How To Be A Travel Consultant

To venture into travel consultancy online businesses in Nigeria, there are a few steps to carefully follow to achieve excellent travel consultant services.

- You have to select a niche: To achieve this, you have to choose from the following travel consultancy branches and focus properly on them.

- International travel consultant

- Local travel consultant

- Corporate travel consultant

- Cruise specialist

- Have a Registered Business Name

- Go through some training.

- Create your online platform that is your office.

- Travel, Keep A Travel Journal, and Take Pictures.

- Publicize Your Services.

22. App Developer

This is one of the good online businesses in Nigeria for anyone with the knowledge of creating, testing, and programming applications for electronic devices such as computers, mobile phones, and tablets. People in this particular field work as a team to come up with an idea and design it to suit the public need or individual need in an application. To fully function in this kind of business, one must have acknowledged coding languages, and their use will have to work in collaboration with graphic artists, data scientists, and others.

They take the application through a series of tests to ensure it gives the required reason for its development. Many marketing firms in Nigeria conduct surveys on customers’ needs towards the application before the application developer concludes on the major need of the pre-developed application. Companies in Nigeria have seen that application helps get their company closer to their target customers and are in desperate need of application developers who will give them the exact solution to their customer’s needs.

For instance, most Nigerian banks have functional electronic applications, which helps their customers conduct self-service banking at their convenience. Application development online businesses are undoubtedly fertile ground that needs to be developed, as they are open to different sectors. They can work as part of IT professionals, software engineers, and system analysts working from the comfort of their home for a company.

23. Website Maintenance Service

Online website maintenance service is the simple act of regularly checking your website for issues and then ensuring that the whole thing is up to date and applicable. You have to do this continuously to ensure that the internet site remains updated, secured, and useful. This encourages an increase in site visitors and boosts your SEO and rankings on Google.

Whether you are a huge business enterprise, a man or woman, or a small business proprietor, it’s far imperative to maintain your internet site up to date. This allows you to interact with clients, drive traffic for your web page, and forestalls predominant problems on your web page.

24. Online Marketing Consultant

The task of a remote advertising and marketing consultant varies significantly with the aid of an employer and assignment; however, it usually entails advising groups on the exceptional way to reach their customers. Remote marketing consultants might compare contemporary marketing efforts and make guidelines for enhancements, plan and put in force social media or different advertising and marketing campaigns, teach different marketers on acceptable practices, and suggest new content material, workflows, or strategies for reaching clients. Then they tune the fulfillment of advertising techniques the usage of analytical equipment.

Attributes That Can Foster Success In Remote Marketing Consultancy

- Have an understanding of how to influence brands.

- Gain your client’s trust.

- Always strive to develop yourself more.

- Have a moderate price for your services.

- Always ask good questions.

- Run thorough research on your client.

- Make use of proper promotion platforms.

25. Online Recruiting Agency

Employing new personnel may be a highly-priced and time-draining task for most leading companies in Nigeria. This makes them resort to Online Recruitment Agencies to handle this critical aspect of the operation. Charges may be a sticking factor; however, companies should know how recruitment corporations receive a commission. It will go a long way in assisting employers in perceiving the best staffing company for their staffing needs and price range.

One can venture into the online recruitment business in Nigeria as most recruitment firms now run their advert on the internet for the general public. Recruitment agencies get this advert, and readvertise them and get their candidate schedule interviews. On successful employment, they charge the applicant 15% to 30% of their first-month salary, and most times, they also get paid by the company.

26. Financial Software Consultant

This is a segment of the financial advisory role. A financial software consultant has complete knowledge of accounting software, its installation pattern, and application in solving digital financial problems. Most companies in Nigeria in this current technological era adopt different accounting software but usually encounter problems that affect the overall financial information of the company. In this category, the software consultant focuses on the proper functioning of the accounting software and an advisory role with tutorials on proper use.

How To Be A Financial Software Consultant

- Have knowledge of different financial software.

- Create a website for your services.

- Promote the financial software you are conversant with.

- Market your services to target companies.

27. eBook Author

Anybody can venture into eBook development. Sound knowledge of electronic devices and how to use ebook production tools can take one into production and publishing ebook materials.

How To Start An eBook Business In Nigeria

- Conduct market research on niches with the highest keyword search.

- Create a website to showcase your eBooks.

- Create enough eBook of interest to readers

- Add a moderate price tag to your site subscription.

- Allow google ad adverts on the website.

28. Software Developer

This role is geared towards designing solutions for corporate companies. This consists of developing computer programs for scientific, commercial, military, communications, aerospace, business, clinical, and standard computing packages. Software developers have to have a wholesome balance of difficult and soft skills. Presently, software developers are also in charge of outlining and developing the code and layout for software. However, these varieties of careers typically contain a lot of collaboration among various stakeholders. If you are in search of online businesses in Nigeria that pay fast, learn software development.

29. Online Business Coach

A business coach is someone who offers you guidance based on their very own experience, mentors you, and asks probing questions to get to the bottom of a problem. As the coachee, you ought to do the work. However, a trainer is there to give a helping hand to achieve your aim quicker and to ensure that you don’t get caught up along the way.

At the same time, a good coach convinces you to develop tools to build your enterprise independently without ultimate dependence on your coach. You spot the business that has continually been about identical standards. There’s no factor in reinventing the wheel and spending years looking to figure out how to grow your enterprise.

As an alternative, you can tap into someone else’s experience. Someone who has been where you are and who can tell you what works and what errors to keep away from. An instructor will let you know what to do to get rapid outcomes. However, an excellent coach will guide you consistently to accomplish your inevitable purpose.

What Makes One Look For An Online Business Coach

- Having lesser income from hard work.

- Lacking time to expand a business.

- A desire to gain more output from employees.

- Can’t determine a profit stand in business.

Three Steps To Becoming An Online Business Coach

- Undergo a training session.

- Have a mentor.

- Gain coaching experience.

30. SEO Consultant

As a search engine optimization professional, you will identify strategies, techniques, and processes to boom the number of visitors to a website and reap an excessive-ranking placement in the effects web page of engines like google. By generating more leads for the enterprise, you’ll open up new opportunities for using growth and profit. This kind of work can be known as content advertising or conversion rate optimization work, and you can rather have the activity name of an online marketer or digital account executive.

How To Become An SEO Consultant

- Study SEO fundamentals.

- Learn essential SEO tools.

- Develop your skills in SEO.

- Sample some of the projects you used perfect SEO.

- Develop your website displaying your SEO skills.

The online businesses in Nigeria mentioned above are lucrative and fun to carry out if the proper steps in engaging them are followed. It can be a daily paying job, can be done by students, and can be done from home at one convenient time.

Recap of 30 Best Legit Online Businesses That Pay In Nigeria

- Freelance Writer

- Online Tutor

- Website Copywriter

- Video Ad Creator

- Online Newsletter Services

- Lead Generation Services

- Podcasting

- Affiliate Marketing

- YouTube Personality

- Online Course Creator

- Web Designer

- Online Researcher

- WordPress Theme Developer

- Blog Network Creator

- Stock Photographer

- Resume Writing Services

- Virtual Tech Support

- Contract Customer Service

- Proofreader

- Domain Reseller

- Travel Consultant

- App Developer

- Website Maintenance Service

- Online Marketing Consultant

- Online Recruiting Agency

- Financial Software Consultant

- eBook Author

- Software Developer

- Online Business Coach

- SEO Consultant